What Is Finished Goods Inventory, and How Do You Calculate It?

Learn what finished goods inventory is and how to calculate it for your business. Make sure you have enough stock to meet customer demand.

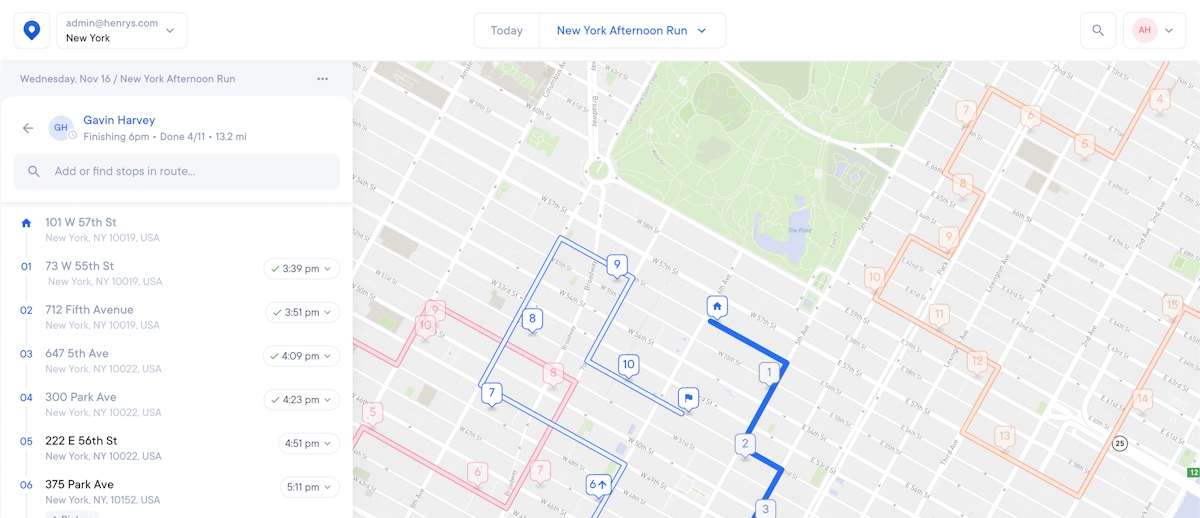

Once your finished goods are ready to send out, trust Circuit for Teams to plan drivers’ routes and get products into customers' hands on time.

If you sell products, you might have heard of the term, "finished goods inventory." This concept refers to the total value of products you have in stock, available for consumers — whether retailers, vendors, or end customers — to buy.

Knowing your business's finished goods inventory value means you can make sure you have enough product in stock to meet consumer demand, among other supply chain benefits. In this article, we’ll go over the advantages of this inventory accounting method and show you how to calculate your finished goods inventory step by step.

Key takeaways

- Finished goods inventory refers to the total number of products a business has in stock, ready to send to consumers.

- A finished good is a complete item ready for a customer sale.

- Tracking your finished goods inventory helps you accurately determine whether you have enough product in stock to meet demand.

- The formula for calculating finished goods inventory is: finished goods inventory = beginning finished goods + (COGM - COGS)

What is finished goods inventory?

Finished goods inventory is represented as a dollar value you can use for financial reporting, pricing decisions, and inventory management. It ultimately tells you how much money you have tied up in your inventory.

You might assume a "finished good" means a product that's ready to put in the end user's hands, but that isn't necessarily the case. A finished good is simply a complete component that's gone through all the manufacturing stages and is ready for distribution.

For example, consider a business that manufactures smartphone chips. For them, the chip itself is their finished product inventory. They can distribute the chip to smartphone manufacturers, who put it into their smartphones and sell that as their finished product.

Here's another example: A textile manufacturer sells textiles, which are made into clothes by clothing manufacturers.

As the end consumer, you might not think of textiles as a finished product. But for the textile manufacturer, that’s the finished product they manufacture and distribute to clothing makers.

These goods are referred to as "merchandise" once they’re sold and purchased in their finished form.

Whatever types of inventory your business has, keep track of it by knowing your finished goods inventory. Calculating your finished goods inventory helps you:

- Optimize inventory management: This helps you make sure you have enough inventory in stock. Plus, tracking direct labor and manufacturing costs helps you find ways to cut operating expenses.

- Minimize materials waste: The longer you have unsold inventory in your warehouse, the higher the risk of it getting damaged or spoiling. On top of that, you have to pay for those warehousing and storage costs. Maintaining your ideal inventory level can help you avoid stocking excess raw materials inventory or finished products.

- Determine gross profit: Knowing your inventory levels also helps you accurately record your business's total assets and worth. This is useful for everything from completing your taxes to preparing the financial statements needed to get an accurate company valuation (in case you want to sell it, for example).

How to calculate finished goods inventory

Calculating finished goods inventory means doing a bit of math. Here’s the formula:

Beginning finished goods + (COGM - COGS)

If that looks complicated, don’t stress. Let’s go through how to figure out each part of the equation.

Step 1: Determine the cost of goods sold (COGS)

First, figure out your cost of goods sold (COGS). This relates to the direct costs of producing your goods. One common formula for determining your total cost of goods sold is:

Raw material costs + Labor costs + Any other direct costs

Raw material costs refer to what you spend manufacturing supplies, labor costs are what you pay the people who produce your goods, and other indirect costs might include manufacturing overhead or other overhead costs.

Step 2: Add the cost of goods manufactured (COGM)

Cost of goods manufactured (COGM) refers to a business's total production costs within a set time period. The formula for COGM is:

Beginning WIP inventory + Total manufacturing cost - Ending WIP inventory

WIP inventory stands for work-in-process inventory — not to be confused with work-in-progress-inventory, which can mean something slightly different in some contexts.

“Beginning WIP inventory” is a dollar amount representing the value of your partially completed products that were still in the production process at the beginning of the current period. Similarly, “ending WIP inventory” refers to the value of partially completed products that are still in production at the end of the current period.

Step 3: Subtract the cost of goods sold from the cost of goods manufactured

With your COGS and COGM calculated, you can now plug those figures into the finished goods inventory formula.

The result will give you the dollar value of your finished goods inventory, which you can use for financial reporting, valuing and pricing your products, and seeing how much financial investment you have tied up in your inventory.

How to manage finished goods inventory

At the end of the day, finished goods inventory can help you make sure you have enough inventory on hand to meet consumer demand. Read on for some tips on managing it properly.

Regularly review and update inventory levels

Inventory auditing refers to the process of reviewing inventory levels and verifying the amount of product you have on record matches what's actually in your storage facility. A physical inventory count means hand-counting each piece of inventory, which is much easier with an electronic barcode scanner.

Why run inventory audits? It helps keep your records accurate and can help identify losses early on. For example, inventory audits can reveal when inventory is being stolen.

You can do inventory audits in-house, counting and recording inventory pieces manually. You can also hire third-party auditors to check your inventory levels, which saves time but costs money.

Either way, compare this data to the inventory levels you have recorded in your business records (for example, in financial statements or inventory accounting software).

Some businesses use a cutoff analysis when counting inventory. This means you pause all operations, notably shipping and receiving, while you check inventory levels to reduce the chance of mistakes.

How often you run an inventory audit depends on business details, like turnover rate and inventory. Monthly is typically the bare minimum, but some businesses count inventory weekly or even daily.

Use inventory management software

An accurate inventory tracking system can help you manage stock, improve cash flow, and save money. Inventory tracking software lets you track inventory from your mobile device using cloud-based storage to keep up with inventory levels in real time.

Popular options include:

- Zoho: This tool includes inventory control software, warehouse management features, and order management functionality. You can track products from the warehouse to last-mile delivery.

- Freshbooks: This tool lets you combine your inventory management and accounting in one interface, streamlining both processes. For example, you can automatically track inventory by accounting period or use it to help with your balance sheets.

- InFlow: This is a cost-efficient tool for B2B wholesalers and distributors, or small businesses with limited budgets. It has all the basic inventory management software features that help with inventory tracking, barcode scanning, warehouse management, and generating reports.

Establish an inventory control system

Inventory management software can help track your inventory levels, but it can't actually organize the inventory for you.

Here are some techniques you can use to handle inventory:

- First-in, first-out (FIFO) system: The FIFO method is simple: The goods you purchase first are also the first goods you sell. This can help you organize inventory in a way that minimizes spoilage.

- Just-in-time (JIT) system: The JIT method means you only order what you need right when you need it. For example, you would wait to order materials from suppliers until you get a customer order so you have just enough inventory to fulfill immediate demand without excess stock.

- Barcode and radio frequency identification (RFID) systems: These can help prevent inventory loss. Every piece of inventory has a barcode, which can be scanned with a mobile device and digitally recorded for tracking using the right inventory management software.

- ABC analysis: This system involves classifying inventory types into three categories — A, B, and C. A includes the most important goods (which generate the most revenue), B goods are moderately important, and C goods are the least important. For example, an inventory split may be A/B/C = 80 percent/15 percent/5 percent.

- Perpetual inventory: A perpetual inventory system continually estimates inventory using electronic records (instead of physically counting inventory). You’ll need a software management system where you can input your starting inventory level and have it automatically update as items sell.

- Economic order quantity (EOQ): EOQ refers to your business's ideal order quantity: the number of orders you can fulfill while keeping costs like warehousing to a minimum.

Monitor inventory turnover rate

Inventory turnover refers to how effectively your business uses its inventory. Calculate it by dividing the COGS by your average inventory value for a given time period.

Regularly monitoring your inventory turnover rate can give you an idea of how efficiently you're handling your inventory, so you can make tweaks as needed. For example, if products stay on the shelves for too long, you might aim to stock less of that inventory.

The final stage of manufacturing

Finished goods inventory is the final stage of manufacturing. At this point, you're done making your product and it's ready to go to your customers.

Calculating your finished goods inventory can help you optimize inventory management, minimize materials waste, and determine gross profits. Luckily, you can calculate your finished goods inventory using a simple formula.

Once your products are ready to ship, Circuit for Teams can help you get them to consumers. This last-mile delivery solution offers route optimization and planning features to get goods where they need to go quickly and efficiently.

Find out more with a free trial of Circuit for Teams today.