How Spoiled Are Consumers With On-Demand Delivery? [Study]

We surveyed Americans to understand what their expectations are with different forms of delivery and to find out whether they are reasonable.

Americans are in love with delivery, but they have high expectations. We surveyed over 1,000 Americans to find out which companies consumers trusted most, as well as how they reacted when a delivery went awry.

Key takeaways

- 66% of Americans would stop ordering from a company or delivery app following a late delivery, while 73% claimed they would order more frequently following an early or timely delivery.

- 51% of Americans blamed the delivering company or restaurant the most for a late delivery rather than the delivery service or driver.

- 54% of Americans have suspected their food delivery driver of eating their food or drinking their drink prior to delivery.

So, are we getting spoiled by on-demand delivery services? Let's take a closer look.

The importance of good delivery

Our study found consumers wanted their food to be correct, quick, and delivered right to their door.

Since the COVID-19 pandemic left many restaurants and retailers scrambling to figure out how to meet much higher demand, companies have had to step up their game to keep consumers happy or else risk losing their business.

Food delivery platforms, like Uber Eats and DoorDash, have helped restaurants who may have not previously offered delivery meet these needs, but bigger retailers in the product delivery space have struggled to compete with the efficiency of companies like Amazon.

But how lofty are the expectations of American delivery customers? Read on to find out what standards consumers had for delivery companies in this expanding space.

How fast do we want deliveries?

In the digital age, speed is paramount, and consumer demand for fast deliveries continues to surge.

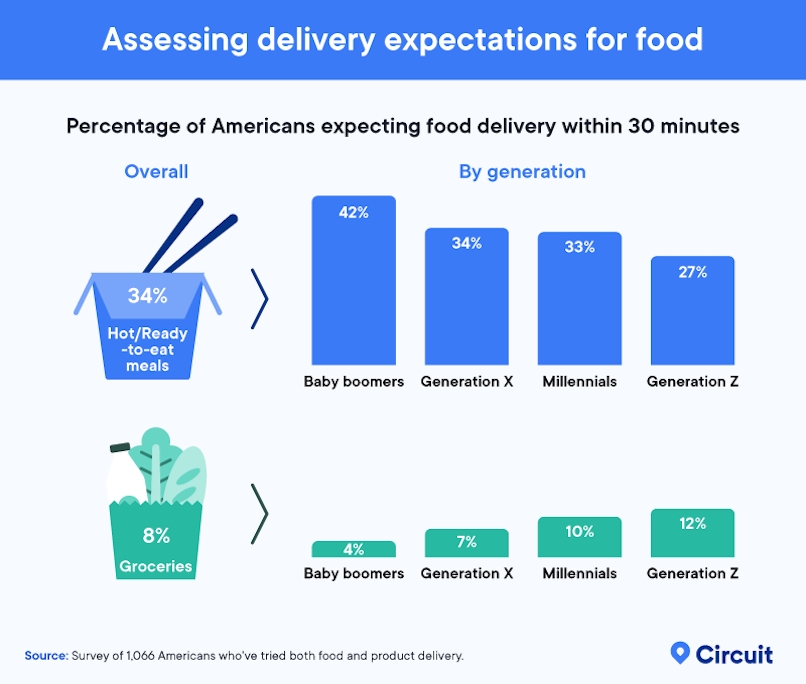

We asked respondents to identify their expectations for speed with ready-to-eat meals against other delivery options, like retail products or groceries, then compared the differences across generations.

Demand for speed was the highest among ready-to-eat meals than any other service, with 35% of Americans expecting their meal within 30 minutes of placing the order.

Baby boomers were the most likely to expect a 30-minute window, however each generation expected this service to be much faster than groceries or retail products. Digital generations, like Gen Z, were more likely than older generations to use technology to track orders and understand timing.

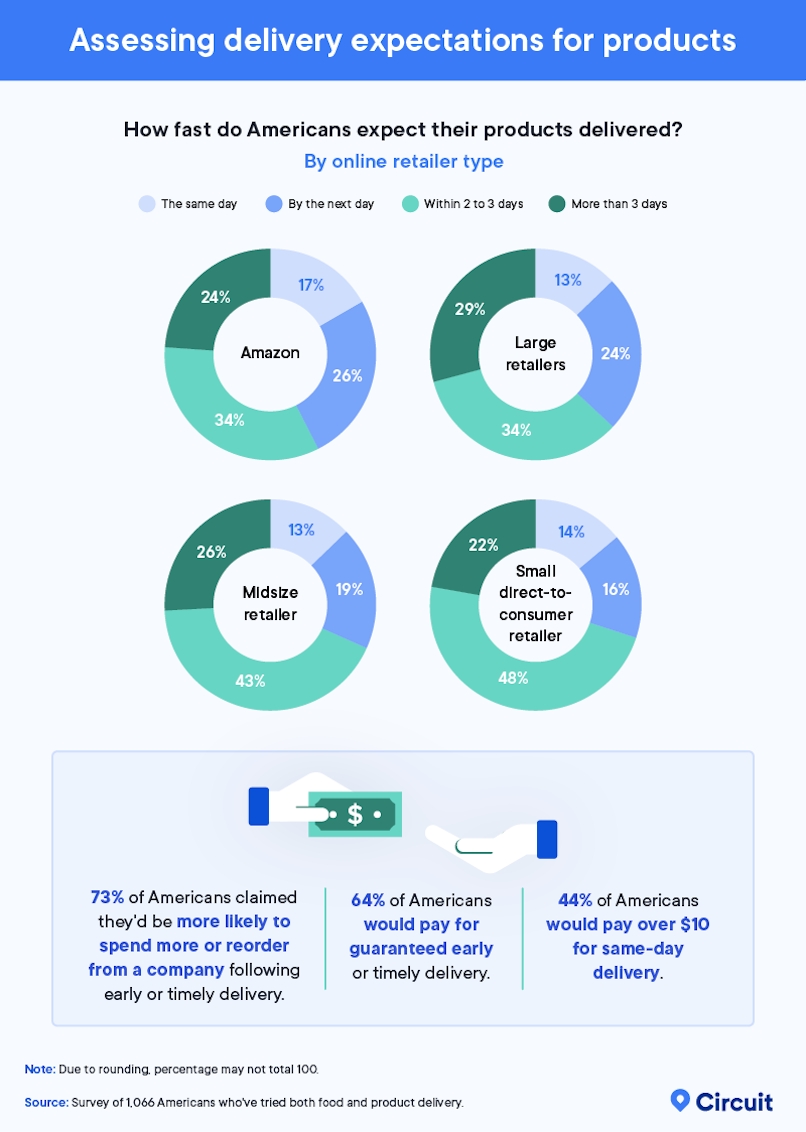

Amazon continues to change the game by upgrading the efficiency of delivery, and they are on track to become the biggest package delivery service in the country in 2022.

Over 75% of Americans expected an Amazon delivery within 2 to 3 days or less, outpacing the expectations held by consumers of other retailers both big and small. Although not yet available in America, Amazon is already invested in the ready-to-eat food delivery space in Europe, with the soon to be public company Deliveroo.

Nearly three-quarters of Americans were willing to reorder from a company that delivered in a timely manner, so it’s no surprise companies that deliver well are thriving.

Key Takeaway: Baby boomers were 56% more likely to expect their hot food delivery to arrive within 30 minutes than Gen Zers.

Sentiments of delivery speed

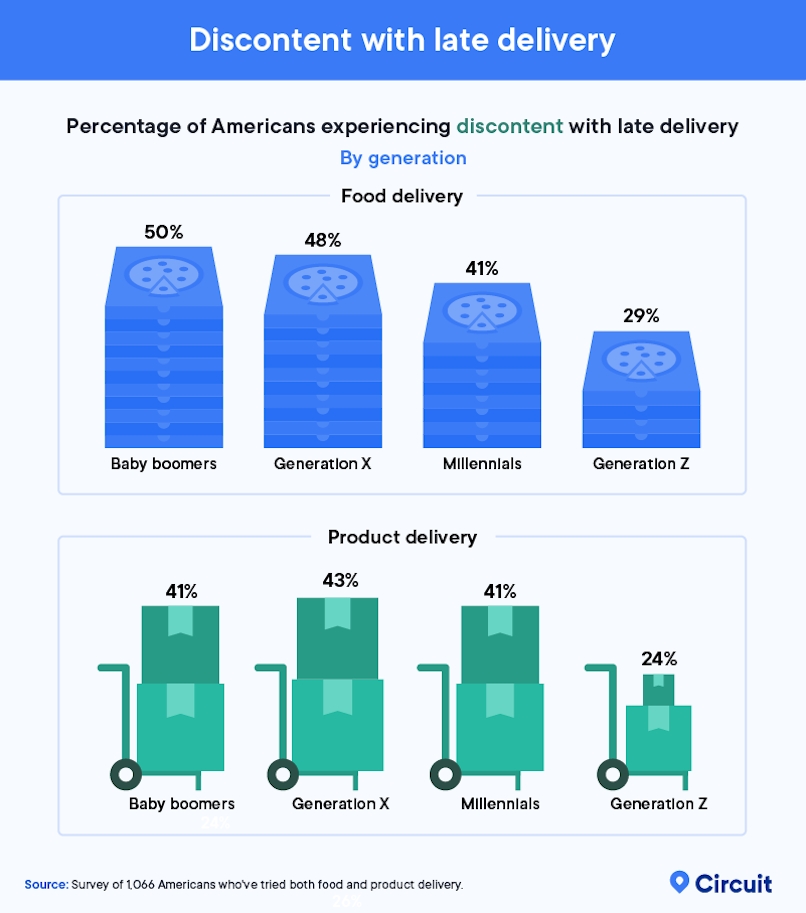

Expectations for on-time deliveries led many Americans to experience discontent with companies who didn’t deliver on their promise of speed. Older generations, like baby boomers, were the most emotionally impacted by a late delivery.

Discontent over a late delivery was higher for ready-to-eat foods than it was for products among every generation we surveyed, except millennials.

Impatience for tardiness regarding ready-to-eat food comes with some scientific explanation as well. Scientists have linked physiological responses caused by hunger to negative emotions, which could be easily triggered by a delayed food delivery and might help explain this heightened expectation compared to other products.

Gen Z were the least affected by tardiness among the generations surveyed and experienced decidedly less discontent.

Key Takeaway: 50% of Baby boomers reported experiencing discontent with late food deliveries, while Gen Zers were more forgiving, with only 29% of them reporting discontent with the same.

Getting delivery done right

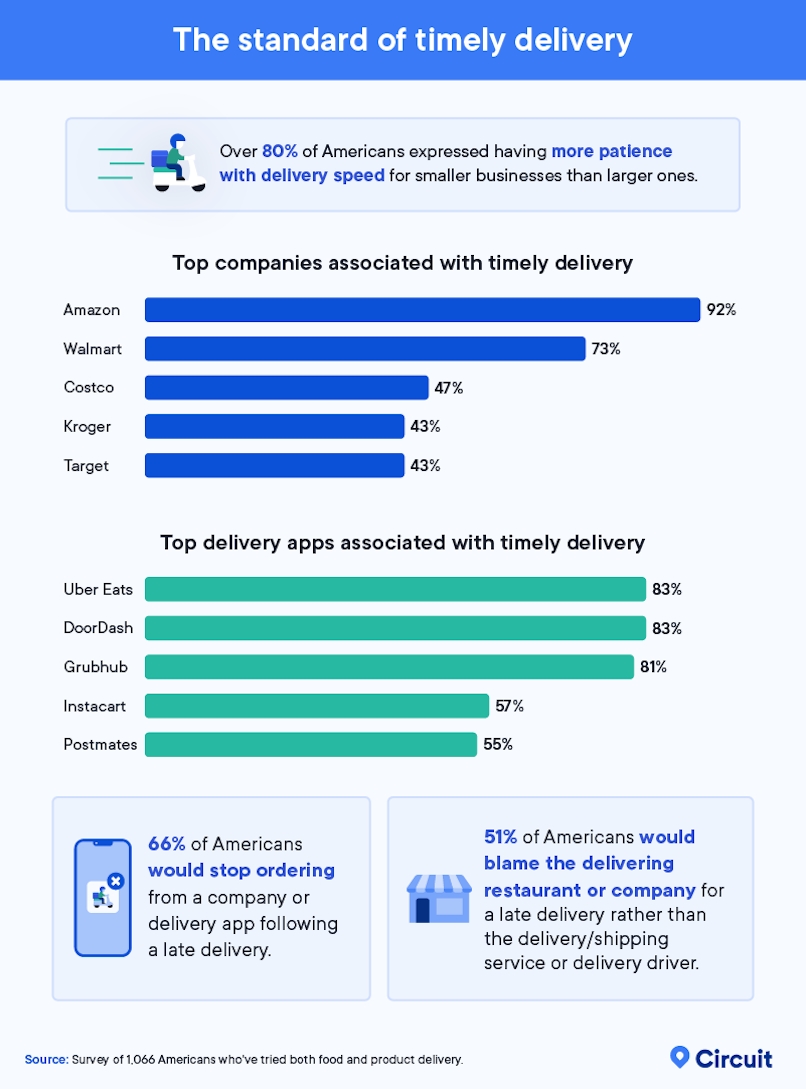

Big reputations came with big expectations for Americans waiting on deliveries. We asked Americans which companies and apps they most associated with a great delivery experience.

The stakes were high for these companies, as 66% would take their business elsewhere if a late delivery occurred.

Not only were Amazon and Walmart the top companies for Americans looking for a timely delivery, they were also the only companies listed that kept their deliveries fully in-house. Walmart has been so successful with its delivery platform, Spark Driver, that it’s offering up the service to other companies with delivery needs.

Costco and Target were not as highly associated with fast delivery. And while giving shoppers this option, they utilize Instacart to get their goods to the consumer. Kroger, on the other hand, is testing the waters in certain markets and having employees deliver goods straight to customers but partnering with Instacart as well in other markets.

Costco and Target each have ground to make up on Amazon, however, which 92% of Americans associated with quick delivery.

Americans associated Uber Eats and DoorDash the most with timely delivery equally. The two apps experienced the most growth in the food delivery market since the pandemic, compared to other platforms like GrubHub.

While Postmates was less associated with on-time deliveries, Uber purchased them last year. With access to Uber’s reliable delivery model, they might be a company to watch in the future as this industry continues to grow and become more efficient to meet rising demand.

Key Takeaway: 51% of Americans blamed the delivering restaurant or company the most for a late delivery, as opposed to the delivery driver or shipping service.

Food delivery disappointments

According to our study, nearly every consumer experienced mishaps with their order, whether it was for a restaurant or a grocery store. We asked people what actions they took directly after their delivery mistake.

Consumers didn’t necessarily blame the driver for issues with deliveries, they instead blamed the company or restaurant for the mistake. Still, over half of Americans reported suspecting a driver of eating or drinking a portion of their order during the delivery process.

The top response for receiving the wrong order was to request a refund. Placing the same order again and hoping for a different result was not far behind as an option.

Most companies have preset options in their help menus to guide users on what steps to take next. Typical options include a refund or a reattempt at delivery.

Nearly 40% of Americans experiencing a delivery hiccup chose to either file a complaint with the restaurant or grocery store. However, if their transaction was with the delivery service, companies like Uber Eats prefer to field these requests themselves.

Issues like this can confuse consumers, which may explain why 24% of customers who received the wrong food went ahead and ate it anyway.

Key Takeaway: 90% of Americans have received the wrong food order from a restaurant or grocery store, and 54% of Americans have suspected their delivery driver of consuming parts of their food or beverage prior to delivery.

High expectations, high reward

Consumers relying on the delivery of meals, groceries, and retail products expect their orders to be correct, delivered to the correct location, and to arrive on time.

These expectations led Americans to believe that some companies, like Uber Eats, DoorDash, Amazon, and Walmart, outpaced the competition and offered a more reliable service that met their high demands.

The emotional backlash of an incorrect delivery could also be influential to consumer loyalty.

Some consumers had such high expectations that they would stop using a company simply over a delay in receiving an order. With these Increasing consumer demands for the immediacy of delivery, the efficiency of delivery is far more important. Circuit Route Planner addresses this by providing optimized delivery routes with any number of stops.

Methodology

Circuit surveyed 1,066 Americans who had ordered food or products for delivery within the last month. 55% of respondents identified as men, while 45% of respondents identified as women. Generationally, 24% of respondents were baby boomers, 25% were Generation X, 28% were millennials, and the remaining 23% were Generation Z. Survey data has certain limitations related to self-reporting.

Fair use statement

If you enjoyed reading about the demands the American consumer has for the food and product delivery industry, please feel free to share this article for noncommercial use. Just make sure to link back to the original article so that our contributors can receive credit for their work.