Guide to MOQ: Minimum Order Quantity Meaning, Benefits, and Tips

Minimum order quantity can help suppliers boost profits while saving consumers money. Here’s how to figure out your MOQ.

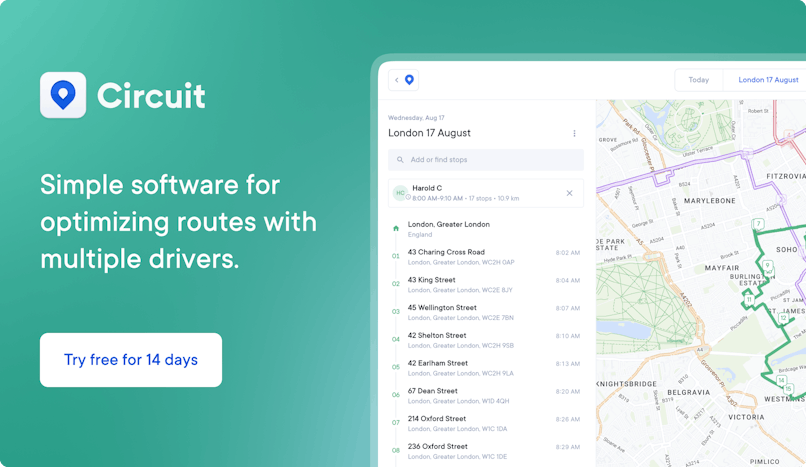

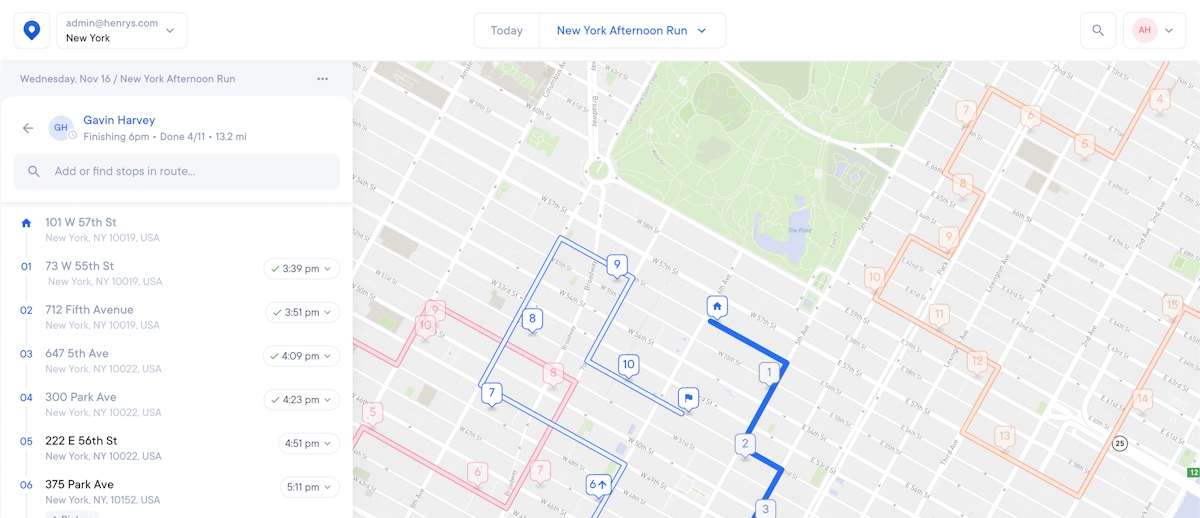

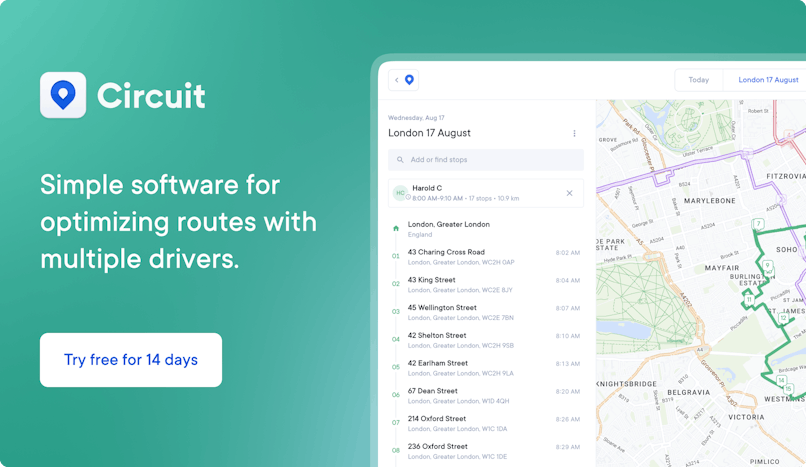

Once you determine the minimum number of units you should sell customers to make a profit, deliver them with Circuit for Teams.

If you work in the logistics and supply chain space, you probably already know some of the many industry abbreviations.

From BOM to PO, CRM, and more, it seems like there’s a never-ending list of acronyms to learn (I even wrote a whole guide on it).

Now, there’s another important term worth adding to your list: MOQ.

MOQ stands for minimum order quantity. It refers to the smallest number of units your business will sell to a single customer in a single order.

Below, I’ll explain what MOQ is in greater detail (with examples) and give you the formula for calculating your own MOQ. I’ll also give you some quick tips on how to negotiate minimum order quantities with suppliers in a way that benefits you.

In the course of this post, you’ll also learn why MOQ matters — for both suppliers and buyers. Believe it or not, MOQ can benefit both sides!

For example, suppliers can enjoy better profit margins (I’ll explain how below). Meanwhile, buyers can save money when buying in bulk since some retailers offer a lower price per unit if ordering multiple units versus just one.

What does minimum order quantity mean?

Let’s keep it short and sweet: MOQ means the minimum number of units a business needs a customer to buy to prepare an order.

Wholesalers who sell products in bulk use MOQ. Why?

They can cut costs by producing and selling items in bulk. The wholesaler wants to make sure it’s worth their time, effort, and money to fulfill an order — which usually means selling more than one unit.

So, if the business has an MOQ of ten product units, a customer must order at least ten product units, or the business won’t fulfill their order request.

(These MOQs are usually posted on the product order page, as you’ll find below).

Every business calculates its own MOQ. There’s no one magic number that’s right for an MOQ. It just depends on details like what kind of products you sell and how much they cost to produce.

Why does MOQ matter? Often, it isn’t profitable for a business to sell just a single product to a customer.

For example, if you sell T-shirts and a customer orders just one, they might pay $5.

Is that $5 going to be enough to cover not only the cost of production but also the costs related to fulfilling the order — like processing it, picking it in the warehouse, packaging it, AND shipping it?

Maybe not.

So, the business might have an MOQ of five T-shirts. The customer then pays $25 (five T-shirts at $5 per piece), which is more likely to cover all those costs and make the company money.

The above example demonstrates why it’s important to determine your MOQ and decide the number of products you’ll have to sell to a customer per order to at least break even — or, better yet, make a profit.

Minimum order quantity example

A real-world example can help make MOQ easier to understand.

You might find MOQ marked when trying to buy items wholesale on eCommerce platforms like Alibaba or AliExpress.

For example, you might use Alibaba if you’re getting into dropshipping (our guide explains how).

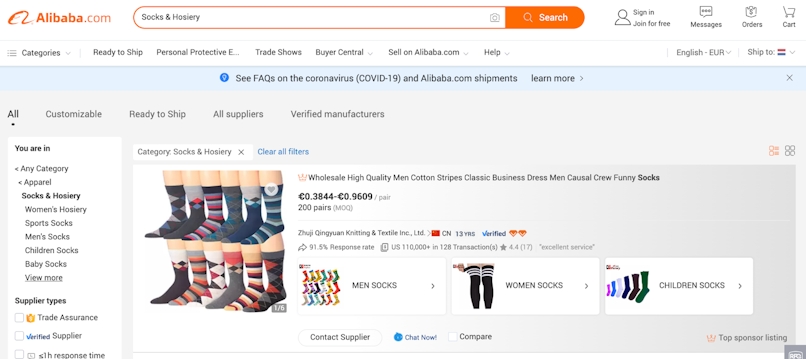

Here, you can see that this sock wholesaler has an MOQ of 200 pairs:

They won’t fulfill your order unless you meet that MOQ.

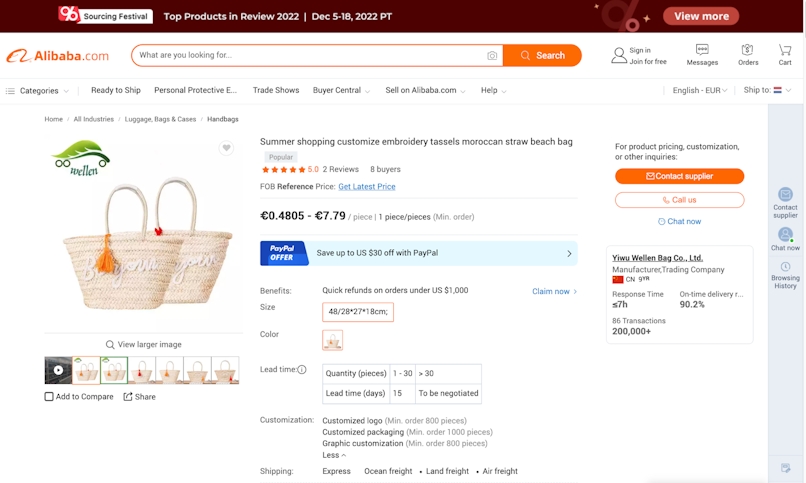

Here’s another example:

In this case, the MOQ for a tote bag is one piece. However, if you want to add a customized logo, the minimum order amount shoots up to 800 pieces (see “Customization” at the bottom of the page).

In this case, adding a customized logo adds production time and cost for the supplier. For this reason, the supplier may have determined that adding a logo is only in their best interest if the customer orders at least 800 pieces.

But just how did they determine that minimum quantity? Keep reading — I’ll explain how to calculate MOQ in the next section.

Minimum order quantity formula: How to calculate MOQ in 4 steps

Now that you know what MOQ is, you’re probably wondering how to figure out your business’s MOQ.

Before we jump in, I should warn you: MOQ isn’t something you calculate once and never revisit. MOQ is likely to change over time because the factors that help determine it, like consumer demand, change over time.

For example, if you sell Christmas decorations, you’ll probably have more consumer demand in early December than in mid-March.

To keep your MOQ up to date, you may want to set a timeline for revisiting it (like monthly or quarterly).

Here’s how to calculate it:

Step 1: Forecast demand

Demand refers to the number of products your customers are asking for as a whole.

Now, unless you have a crystal ball, you can’t predict the future and know exactly how many product units will be ordered in a given day, week, month, or year.

But you can use demand forecasting to estimate this number, so you can reasonably anticipate how much of a product you need to stock to meet customer demands (this can also help with capacity planning).

The best way to predict the future is to look to the past: Gather your sales data from previous years and break it down on a month-by-month basis to find how demand shifts over time.

Future years will probably reflect similar trends.

For example, if you sell swimwear, you may see demand go up in the spring when people are preparing for summer beach getaways.

Here’s an example of a fictional company, Super Swimwear, LLC:

As you can see, the number of units sold went up significantly in the warmer months. If you own Super Swimwear, LLC, you might prepare for the busy summer season by upping the amount of stock you have on hand.

Step 2: Calculate inventory holding costs

Inventory holding refers to the process of actually storing inventory before it’s ordered by and shipped to customers.

You likely have to pay some costs for inventory storage (known as inventory holding costs).

For example, you might rent space in a warehouse to store inventory or rent out an entire warehouse for yourself (learn more about warehousing).

If you’re a small business owner, you might stash inventory in your home garage (meaning no added costs).

Some types of inventory can also be pricier to store than others. For example, goods needing refrigeration have added electricity costs associated with cooling.

Let’s say you’re the owner of Super Swimwear, LLC, and you rent out a small space in a shared warehouse to stash your products.

You pay $100 per month. Your annual inventory holding costs are $1,200 ($100 x 12 months).

If your bikinis aren’t selling fast enough, you have to rent an extra storage unit for additional stock. You rent it on a month-by-month basis, so it costs more: $150 per month.

Let’s say you’ve had to rent an extra storage unit twice in the year, totaling $300 extra in inventory holding costs — so that means $1,500 total in inventory holding costs for the year.

Step 3: Find your break-even point

The break-even point refers to how many product units you need to sell to break even (it’s not a profit, but it’s also not a loss) when considering all related costs.

These costs could include:

- Production costs needed to actually make the products, like labor, raw materials, and consumable manufacturing supplies (like energy to power machinery)

- Order fulfillment costs, like picking products from warehouse shelves, product packaging, and shipping costs (like shipping labels and carrier rates)

Let’s continue with the Super Swimwear, LLC, example. To make one bikini, your labor costs are $25, raw materials and supplies costs are $15, and order fulfillment costs are $10.

Your labor, production, and fulfillment costs add up to $50. That means you need to sell a single bikini for $50 to break even.

Step 4: Determine your MOQ

Once you have the above data, you can use it to help determine your MOQ. Let’s continue with the Super Swimwear, LLC, example.

Here’s what you know:

- Demand is higher in the warmer months.

- Your inventory holding costs are $100 per month or $1,200 per year, plus the $300 in extra storage costs — so $1,500 total.

- You need to sell a single bikini for at least $50 to break even.

In the high-demand months, you might be fine with a lower MOQ because you know you will move product quickly.

In lower-demand months, you might increase the MOQ to recover costs like shipping and packaging.

This can also minimize the risk that extra stock will pile up and you’ll have to pay for that extra storage unit.

You can also save on each order as you increase your MOQ. Here’s how:

Let’s say you specify a minimum order of three bikinis per customer. The fulfillment costs, including packaging and shipping, are $10 per bikini.

Since you can package three bikinis for the price of one, you’re saving $20 ($10 for each of the two extra bikinis).

Now, you’re selling three bikinis for a total order value of $150 and making a profit of $20.

That might not sound like a lot, but it adds up fast. If you sell just one combo pack of three bikinis every day of the week, that’s $140 in a single week, $560 in a single month, and $6,720 in a single year.

MOQ benefits for buyers and suppliers

MOQ is helpful for buyers and suppliers in different ways. Here are some of the advantages that make MOQ worthwhile for all involved.

Minimum order quantity benefits for buyers

Buyers benefit from MOQ in a few ways, including:

- Save money: You’ve probably bought something online or in a store and benefited from a “two for one” or “buy two, get the third free” kind of deal. An MOQ similarly saves you money by encouraging you to buy in bulk. When buyers order larger quantities, the cost per product unit is generally cheaper than for a single product.

- Better supplier relationships: Ordering from suppliers in bulk can help you build positive relationships over time. For example, you might be able to work with suppliers to negotiate the MOQ, like splitting one large order between multiple buyers (so the MOQ is met but you don’t end up with too much inventory).

Minimum order quantity benefits for suppliers

If buyers save thanks to MOQ, it might seem like bad news for suppliers. But suppliers also benefit from MOQ.

Here’s how:

- Lower inventory cost: Selling products in bulk can help you move larger quantities of goods more quickly, allowing you to have a smaller warehouse and associated warehousing costs. This can also help you reduce inventory holding costs.

- Bigger sales numbers: When you set MOQs, you don’t have to rely on many smaller buyers to order many individual products. Instead, you can sell in bulk, earning more money with a single order. This can increase your earnings.

- Improved cash flow: Cash flow refers to how much money transfers in and out of a business. A healthy cash flow can help you make sure you always have enough money on hand to cover operational costs like labor or warehousing. The improved earnings associated with MOQ can also improve cash flow.

- Boost profits: A well-researched and calculated MOQ can help you increase the amount of money you earn from product sales after taking off expenses like production and order fulfillment costs. The example for Super Swimwear, LLC, shows how this is possible. By selling items in bulk, you can reduce the cost per order (like labor, production, and fulfillment). This means more money left over for profits.

High vs. low minimum order quantities

Now that you’ve got the basics of MOQ down, there’s one more thing to know. There are different types of MOQ: high and low.

Low MOQ is generally one to 50 units.

A business with this kind of MOQ is likely a smaller startup that’s new to the industry and still figuring out its target market.

A low MOQ can be beneficial at this point because it won’t deter customers (who might otherwise be scared off by larger MOQs).

As the business grows and customers gain trust, it might increase the MOQ.

A high MOQ doesn’t have a set number. It’s better suited for established businesses with the money and capacity to keep a lot of inventory on hand to fulfill large bulk orders.

More inventory means more money spent on things like warehousing, material handling, and related labor costs.

Minimum order quantity (MOQ) vs. economic order quantity (EOQ)

Economic order quantity (EOQ) is a term used when discussing MOQ.

EOQ refers to the ideal quantity of inventory your business should buy to reduce inventory holding costs, order costs, and shortage costs.

Your business must pay shortage costs if it doesn’t have inventory in stock. For example, you might pay for rush manufacturing if a customer orders a product and you don’t have it (which can cost more).

(Learn how to deal with backorders.)

You might also have to pay for rush shipping to get the product to the customer on time. For example, overnight USPS shipping starts at $27.25.

While MOQ refers to the minimum amount of product your business needs a customer to order, EOQ refers to the amount of inventory your business buys to keep in stock.

The right EOQ lets your company meet consumer demand without facing stock shortages.

It can also help reduce the risk of inventory taking up warehouse space without selling.

Inventory that sells slower is usually stocked toward the back of the warehouse, where it’s harder to reach.

Inventory that sells faster is kept upfront, where it can be found quickly. This is called the first in, first out method (FIFO).

The EOQ formula is based on things like demand, order cost, and holding costs.

Some of the same dependencies that help you figure out MOQ go into calculating EOQ. But these are two distinct terms and refer to two different things.

Learn all about EOQ and how it’s calculated.

How to negotiate minimum order quantities

If you own an eCommerce shop and work with suppliers (like those shown in the Alibaba screen grabs above), MOQ is very relevant to your business success.

Why? You want to buy enough inventory without buying too much (which increases the risk of sitting on stock you can’t sell).

Let’s say you want to order baseball caps from a supplier. Their MOQ is 500 pieces. You order 500 caps, but you have trouble selling them.

You end up with 200 unsold caps. That’s a lot of wasted inventory (and lost money).

But what if you could negotiate with the supplier and get a lower MOQ?

Here are some tips for negotiating MOQs with suppliers:

- Negotiate materials. A product made with high-quality materials likely costs more to produce, which can result in the supplier upping the MOQ. Ask the supplier if they can swap out high-cost materials for lower-cost materials for a lower MOQ.

- Team up with another buyer (or two). If you want to buy an item but the MOQ is super high — say, more than 1,000 — you might be able to split the order with other buyers. Team up to meet an MOQ with large quantities and split the costs and inventory, so neither of you has more (or pays more) than necessary.

- Prioritize popular products. Manufacturers tend to focus on products that sell well and produce these more frequently and in greater quantities. This ups production runs (when the manufacturer makes large amounts of a single product at once) based on demand. Since they know they can easily move these products, they might likely lower MOQs. Ask which products they manufacture most often to find possibilities.

- Split the order up. Some manufacturers may agree to split large orders (pay for and receive half the inventory immediately and the second half a few months later). This makes sure you still have the goods you need without wasting warehouse space, allowing for more cost-effective business operations.

A good existing relationship can help when negotiating a supplier’s MOQ.

Why? If you’ve been working with the same supplier for an extended period, they might be more likely to adapt.

They know you’re a reliable repeat customer (who pays)! This may make them eager to keep your loyalty.

Knowing this can also boost your confidence when negotiating and encourage you to assert yourself.

MOQ conclusion

Minimum order quantity (MOQ) is the smallest number of units a business will sell to a single customer in a single order.

There’s no one number that’s the right MOQ.

Each business has to figure out its own MOQ based on time-sensitive dependencies like customer demand, inventory holding costs, and the break-even point.

The points used to calculate MOQ can also be used to calculate economic order quantity (EOQ).

But EOQ is different from MOQ: It refers to the ideal quantity of inventory your business should buy to reduce inventory holding, shortages, and ordering-related costs.

Be aware that the factors that impact EOQ and MOQ can change over time. That means you’ll have to revisit MOQ and EOQ on a regular basis.

For example, consumer demand for items like swimsuits or Christmas decorations might be seasonal.

Why does MOQ matter? Suppliers can set an MOQ to help lower inventory costs, improve sales figures, enhance cash flow, and even boost profits.

MOQ doesn’t just benefit suppliers, however. It can also help buyers, allowing them to buy in bulk and pay less per product unit.

As a buyer, it’s in your interest to negotiate favorable MOQs.

I’ve outlined some techniques for negotiating a favorable MOQ above. Examples range from requesting lower-quality (and lower-cost) materials to teaming up with another buyer to split large MOQ quantities.

This information gives you basic MOQ knowledge to help you as a buyer or supplier.